Let us analyze the ZigZag strategy today if it is worth to count on or not.

ZigZag indicator, so is it worth it?

To be honest, I’m not pretty sure for what purpose this indicator was developed really but I personally I believe that this indicator was created to see the near highest/lowest values and also to see the market trends.

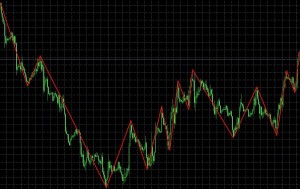

The red line is the ZigZag indicator.

At a glance of the red line, I can feel like sell trends at first and later it has changed into buy trends. In addition, there are some points of “standby”, this could be understood as “supporting point” or “resistance point”. Some people use this indicator to see the “Elliot Wave”. (Personally, I do not count on this theory so I don’t use ZigZag indicator for it and I don’t think I will do it in future).

I think this could be used for the “Dow Theory” as well, it would help user to judge the market trends. (If the both of the highest and lowest values are stronger, it could be understood as buy trends, in opposite case sell trends).

The strategy with the ZigZag indicator

Let’s analyze its feasibility with following conditions.

- Place the stop orders on the previous top/bottom line. (Buy limit at the last highest and sell limit at the last lowest).

- Replace the stop orders when the top/bottom line is updated.

- Both Stoploss and Takeprofit shall be a fixed value. (Always bigger Takeprofit than Stoploss).

That’s all. It doesn’t sound realistic to gain profit by such simple conditions. However the simple theory is sometimes much more sophisticated than any other complicated method.

Having drawn the strategy, now let’s make the Expert Advisor (here in after EA) and see its result by the backtest.

To use the not pre-installed indicator on MT4 terminal, we have to use the iCustom function.

zigzag=iCustom(Symbol(),0,”ZigZag”,depth,deviation,backstep,0,1);

Texts in blue color are the parameters for the indicator; you have to indicate all of them. Three in case of ZigZag)

The zero is for the buffer. If you don’t use any other indicator but ZigZag we may leave it as zero. After the zero is the Shift number, meaning the number from the latest bar.

In case of ZigZag, the system shall send zero while it gets the top/bottom point, so let’s use the loop by “for”.

for (i=1; i<bars; i++) {

zigzag=iCustom(Symbol(),0,”ZigZag”,depth,deviation,backstep,0,i);

if (zigzag!=0) return(zigzag);

}

*bars shall have the value got by iBars function.

The above code send by the latest bottom point but in case of ZigZag strategy we’ve thought shall use the one point before. (see below image)

When the current price goes over the yellow color circle, the strategy starts. (The x point shall not be used).

Backtest

The backtest was done by: EURUSD, H1, January 2010 to May 2015. Stoploos 40 Points (4 Pips), Takeprofit 200 Points (20 Pips), Lot size 0.10 (Fix).

The backtest result is promising. PF is 1.6.

The profit trades % is 25, to be honest it sounds small but it doesn’t matter since this strategy count on “one victory between four challenges”. (Small losses and time-to-time big win).

This strategy is the trend following, if we use it for the big trends situation it will give us a big benefit. (Sometimes it’s easy to see the trends very clearly).

On the other hand I would like to use the AutoLot function, I must include it on the strategy.

I believe this strategy is not worth to be used only for the pending orders but for a normal manual trading as well.

The key points about the ZigZag Breakout strategy

Summing up the points, we see that one strategy is worth just by “breakout with the latest top/bottom point, trend following, and small losses with big profit”. This is one of my philosophy but I must say that the simple strategy is the sophisticate and beautiful strategy.

It’s so normal and everybody know it as important but it’s hard to do.

In addition, I work with the reverse strategy but it is not recommendable for everybody especially if you are someone who find difficulties to win on the Forex, I may recommend to use the traditional method. (Please do not try with the reverse strategy if you are not sure about what you are doing. I must tell you that it is a quite difficult strategy.

For example, I use the reverse strategy for the trendless situation).

So how to improve the ZigZag Breakout Strategy?

It depends on person but for example in my case, I rather want more than PF1.6. (My target shall be PF2.0…!)

1) Changing the time frame

To gain more win possibility, let’s change the parameters a little by little.

I personally believe that the time frame shorter than H1 could have more fake breakout but let us see the result.

M15, TP 20 pips, SL1.5 pips.

PF1.37、Profit trades % is 9.30%. The percentage was reduced drastically but the trade number has increased to 3.805 trades.

2) Changing the trading timing

Let’s limit the operating time only on the “easy to win hours”.

I used the GMT02:00 to 20:00 since the proficiency is better.

PF1.48. Profit trades % is about 10.

3) New additional indicator: “Volumes Indicator”

Let’s see if the trends has enough power to breakout.

At first I tried with ADX indicator but its result was not good. Now I’ve studied the Volumes indicator and I found it convincing.

Let’s modify the system to place positions only when the results is over 2.600 on H4 time frame. The PF is 1.70.

* H1 and M15 are not convincing. (H4 > H1 > M15)

4) Beak Even and Trailing Stop functions

To assure the account balance, we shall use the Break Even function (SL on +0.1 pips). Also, to take advantage fully of the breakouts, let us implement the Trailing Stop. (TP 80 pips with Trailing Stop)

PF2.74

Now the system looks even more convincing… I may configure the Break Even to 1.5 pips so that it could compensate the losses by SL. (It could worth its performance but users feeling shall be better to see some small profits instead of continuous small losses that sometimes could happen).

* I have tried others such as EMA, RSI, CCI for increasing the proficiency with the ZigZag strategy but the result was not fine.

On the other hand, I have noticed that the bigger TP with lower SL make the PF higher but the Profit Trade % becomes lower and lower. (For example, 10 winning trades while 1000 trades… 1% Profit Trade % is too little to think it for the real trading).

Multi pairs

I believe this strategy shall be functional with other currency pairs.

GBPUSD, AUDUSD and USDJPY seem also convincing; they are about PF1.6 to 1.8. (Though I believe, the better currency pair is EURUSD since its trend tends to continue for long). Other pairs could be also feasible as well.

In case of manual trading, it’s often better to concentrate into a few selected currency pairs since it’s complicated to manage off pairs with many time frames. However, in case of the system trading by EA, it’s often better to count on many pairs and many time frames since the EA works for you when you are not behind the computer.

Conclusion about the ZigZag Breakout Strategy.

- It seems convincing to trade with the ZigZag indicator

- Small losses with bigger profit

- Time frame seems important to be chosen carefully

I believe it’s also important to try this strategy in a better moment, with a strong trend. (By using EMA it worked fine to judge the timing however the total number of trades becomes too few so I have skipped to use EMA but maybe I may try it again to improve the ZigZag Breakout Strategy).

On the other hand, other techniques like; MA, Bollinger Bands, Double Zero to judge the better price to trade, etc-etc. could also work with this strategy.

This time, I focused on the Breakout but I also find some possibilities on the Reverse Entry after reaching the ZigZag tops. I shall analyze it in other occasion.

Breaking News: ZigzagBreakOutEA

Now ZigZag Breakout Strategy is available as an Expert Advisor for MetaTrader4 is available. I didn’t have the intention to sell this strategy but I have received so many requests from many people. This EA is a program that I have used it on my demo and also on my real Forex accounts. I believe its real performance is almost identic with the result on the backtest.

If you are interested in this EA, please read the following article.

Business Calendar

Business Calendar